If your friend wrecks your car, your auto insurance policy will probably be the one to cover the accident. However, if the accident was not your friend’s fault, another driver’s policy may cover the damage to your car and any injuries your friend suffered.

Car insurance in Georgia follows the car, not the driver. This means that if your friend causes an accident while driving your car, your insurance—not your friend’s insurance—will be mainly responsible. However, your friend’s car insurance may provide secondary coverage. Insurance companies are always looking for excuses not to pay claims, and there are several situations where your insurance company may refuse to pay, leaving you personally responsible.

Who will pay for the damage and injuries if I let my friend drive my car?

It depends on whether your friend caused the accident. If the accident was another driver’s fault, the other driver’s insurance company is legally responsible for all the damage and injuries caused by the accident. You and your insurance will not have to pay anything.

If the accident is your friend’s fault, your insurance company will be responsible for covering the damage. You will need to call your insurance company to make a claim. If you have a deductible, you will have to pay it. And after the accident, you may be hit with higher insurance premiums.

Your insurance company will pay for injuries and damage up to the maximum amount of coverage you have. If the damage is greater than that, your friend’s insurance can provide secondary coverage, paying for damages over and above the amount your insurance will cover. But if your friend doesn’t have insurance, accident victims could potentially look to you personally to pay.

What if it was my roommate?

Many insurance companies require you to add people to your policy if they will be driving your car regularly. Roommates, girlfriends/boyfriends, nannies and caregivers may fall into this category. If someone drives your car all the time and you haven’t listed them on your policy, the insurance company may refuse to pay for the damage.

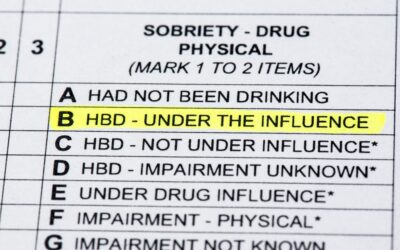

What if my friend was drunk?

If your friend was driving under the influence, they will be responsible for any criminal or traffic charges that result from the accident. You may have a harder time getting your insurance company to pay for the damage they caused, especially if there is evidence that you knew your friend was drunk—or likely to get drunk—but let them take the keys anyway.

What if my friend “borrowed” my car without asking?

If your car is stolen, you are not liable. But a friend “borrowing” your car is viewed a little differently. Because it is hard to prove that your friend didn’t have your permission to take the car, your insurance will usually be responsible for paying for any damage your friend causes. However, if you can show that your friend did not have your permission, your friend’s insurance will be the primary one to pay and your policy will provide secondary coverage.

What if my friend didn’t have a license?

If you let an unlicensed friend drive your car, you could face additional liability. This is because most insurance policies don’t cover unlicensed drivers. If your unlicensed friend is at fault in an accident, it is likely that you and your friend will both be liable for all the costs, and there will be no insurance money to help you. For this reason, it is a good idea to ask to see your friend’s license before you let them drive.

What if I was a passenger?

If you were a passenger, you have a right to recover money to pay for ALL your injuries, plus the damage to your car. This is generally true even if you were in your own car and someone else was driving. A car accident law firm in Atlanta Georgia can explain whether you have a claim and can help you get money from the insurance company.

Talk to an Atlanta Car Accident Lawyer for Free

Our lawyers are ready to help you get the money you need after a car accident. We won’t charge you unless we win you money. Let us give you a FREE, no obligation consultation to discuss your claim and help you decide what to do. Call us at (404) 341-6555 or fill out the form to the right to get your free consultation today.